-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Teletext

Please enter a stock code or name to get quote details.

| Day High | -- | Day Low | -- |

| Open | -- | Prev. | -- |

| Turnover | -- | Volume | -- |

| Day Change | -- | Lot Size | -- |

| Lot Amount | -- |

Xinquan(603179.CH) - Accelerating globalization

Friday, July 11, 2025  566

566

Xinquan

| Recommendation | BUY (Upgrade) |

| Price on Recommendation Date | $45.270 |

| Target Price | $54.370 |

Weekly Special - 002472.CH Shuanghuan Driveline

Company Profile

Xinquan Co., Ltd., founded in 2001, offers a full range of interior and exterior trim assembly products for both commercial vehicles and passenger vehicles. With industry-leading process competence, cost control capability and technical strength, the Company is capable of simultaneous development with OEMs. In 2024, the Company reported revenue of RMB13,264 million (RMB, the same below), up 25.5% yoy; and net profit attributable to the parent company of RMB977 million, up 21.2% yoy. In Q1 2025, the Company reported total revenue of RMB3.52 billion, up 15.5% yoy; and net profit attributable to the parent company of RMB210 million, up 4.4% yoy.

Investment Summary

Stable growth in results

In 2024, the Company reported revenue of RMB13,264 million, up 25.5% yoy, mainly driven by the ramp-up from key downstream customers. Net profit attributable to the parent company was RMB977 million, up 21.24% yoy. Sales to the top five customers amounted to RMB9,889 million, up 38.16% yoy. In Q1 2025, the Company recorded revenue of RMB3,519 million, up 15.5% yoy. Among key downstream customers, the global production volumes of Chery, Geely, Li Auto and Tesla in Q1 2025 increased by 17%, 48%, and 16%, and decreased by 13% yoy, respectively. Net profit attributable to the parent company was RMB213 million, up 4.4% yoy. The gross margin was 19.5%, up 2.0 ppts yoy, showing stable performance, while the net profit margin fluctuated in the short term mainly due to: 1) Overseas business being in the capacity ramp-up phase, resulting in a mismatch between personnel expenses and per capita output; 2) An increase in employee welfare expenses during the period.

Continuous expansion of product portfolio and enhancement of per-vehicle value

While focusing on interior and exterior trim products such as automotive instrument panel assemblies and bumper assemblies, the Company is actively developing its automotive seat business, continuously enriching and expanding its product portfolio to meet existing customers’ demand for integrated interior and exterior system solutions. In 2024, the interior business achieved steady growth, with revenue from instrument panel assemblies, door panel assemblies, and interior accessories reaching RMB8,348 million, RMB2,167 million, and RMB416 million, up 19.6%, 23.9%, and 12.4% yoy, respectively. The exterior business saw rapid volume growth, with bumper assemblies and exterior accessories generating revenue of RMB474 million and RMB229 million, up 415.0% and 29.0% yoy, respectively. The Company is currently accelerating capacity deployment for its seat business, with planned seat back panel capacities of 400 thousand sets in Mexico and 500 thousand sets in Slovakia. Additionally, the Company recently acquired a 70% equity interest in Anhui Ruiqi to accelerate seat business expansion with Chery Automobile. The new business is expected to further enhance the per-vehicle value contribution and lay a solid foundation for the Company’s long-term development.

Accelerated globalization with strong contribution from the North American market

The Company has invested in and established production bases in Malaysia, Mexico, and Slovakia, and set up subsidiaries in the United States and Germany to cultivate the Southeast Asian, North American, and European markets, thereby promoting global expansion. In 2024, the overseas markets made rapid progress, with revenue in Southeast Asia, North America, and Europe all achieving high yoy growth. Among them, the North American market was the standout performer, with revenue reaching RMB700 million, up 89.14% yoy, and a gross margin of 26.37%, up 2.1 ppts yoy. This was mainly driven by the Company’s channel expansion and acquisition of new customers in North America, including a significant increase in orders from internationally renowned electric vehicle brands. Looking ahead to 2025, the production base in Slovakia is expected to commence operations, which will further expand the Company’s channels and customer base in the European market.

Investment Thesis

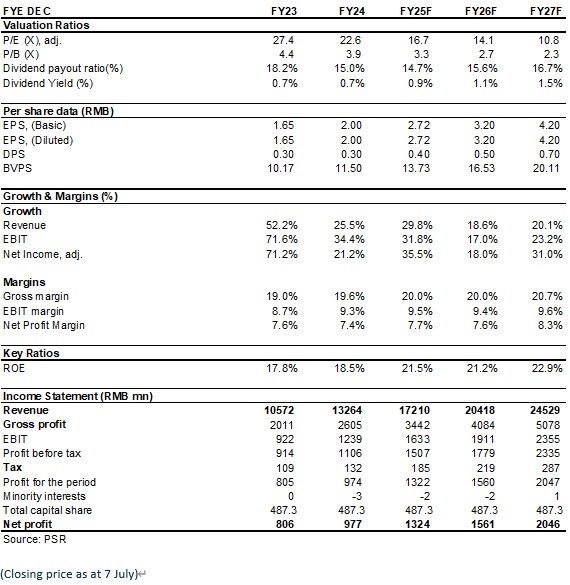

Xinquan is a promising domestic automotive interior and exterior decoration enterprise. With the continuous expansion of the clients base and production capacity, it is expected to maintain sustained growth. We are optimistic about the long-term development of the Company and expect EPS to be 2.72/3.20/4.20 yuan respectively for 2025/2026/2027, a yoy increase of 35.5%/18.0%/31.0%. We offer a target price of 54.37 yuan, respectively 20/17/12.9 P/E for 2025/2026/2027, and an "Buy" rating. (Closing price as at 7 July)

Risk Factors

1) Progress of new production line is below expectations

2) Electric vehicle sales fall short of expectations

3) Macroeconomic downturn affects product demand

4) Sharply rising raw material prices or sharply falling product prices

Financial Data

For more information on related options strategies, please click here.

Top of Page

|

請即聯絡你的客戶主任或致電我們。 市場拓展部 Tel : (852) 2277 6666 Email : marketing@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|