PURAPHARM CORPORATION LTD. (1498)

Commentary:

|

Stock: |

Purapharm Corporations Ltd. |

|

1 Month H/L: |

1.35 – 1.57 |

|

Stock Code: |

1498.HK |

|

52 week H/L: |

0.67 – 2.00 |

|

Market Cap.: |

HKD 574.051M |

|

Listing date: |

08/07/2015 |

|

Stock Outstanding: |

395,897,275 shares |

|

Listing price: |

5.98 |

|

P/E (TTM): |

N/A |

|

Chairman & CEO: |

Mr. Chan Yu Ling, Abraham |

|

Dividend: |

N/A |

|

Major Shareholdes: |

1. Chan Yu Ling & Man Yee Wai, Viola – 55.55% |

|

Dividend Yield: |

N/A |

|

|

|

|

|

|

|

|

|

Established in 1998, the company developed into one of the well-known Chinese medicine company in Hong Kong and China. Their business comprised of the following: research & development, production, marketing and sale of concentrated Chinese medicial granules (CCMG) to China and Hong Kong; sales of their own developed Chinese health care products; operating Chinese medicine clinics under the “Nong's ®” brand and run Chinese herb planation as well as trading their raw produce.

The company released its 2021 annual result (year ended on 31st December) on the 29th of March, the table below briefly summarised the company's performance:

|

Business segment |

Business description |

Remarks |

|

China CCMG |

the group is of the five company that obtained a license from China Food and Drug Administration (CFDA) to produce and sell CCMG products in China

|

Revenue increased by 26.8% to HK$353.0 miilion. This segement represented approximately 53.5% of the company's total revenue. The company attributed the increase in sales to the following factors: 1. New national standards of CCMG by PRC Government. The Chinese National Medical Products Adminstration (“NMPA”) released new rules in which the producers must comply in order to sell CCMG products in China. It is likely that consumers make purchase prior to the implementation of the new rules. The impact of the new standards to the company is unclear at this stage. 2. Another attribution to the increase in sales is the consumption of CCMG rose in the second half of 2021. |

|

Hong Kong CCMG |

Sales of CCMG products to hospitals, Chinese medicine clinics and private Chinese medicine practitioners. |

Revenue increased by 11.1% to HK$162.74 miilion. This segement represented approximately 24.7% of the company's total revenue. The company continued to hold a leading position in providing CCMG in the Hong Kong market.

|

|

Chinese healthcare products |

Sales of Chinese health care products to USA, Japan and Hong Kong markets. |

Revenue decreasd by 8.9% to HK$78.10 miilion. This segement represented approximately 11.8% of the company's total revenue. The decrease was affected by the drop in sales in USA market. The COVID-19 pandemic in USA and subsequet measures to subdue the outbreak caused a disruption in the supply chain for raw materials as well as labour supply, both these factors contributed to the sales decline in America. On the other hand, sales of Chinese health care products in Hong Kong was stable and recorded a slight increase of 1.6% in comparison to last year.

|

|

Nong's ® Chinese medicine clinics |

Chinese medicine clinics that provide medicial services and sales of CCMG products |

Revenue increased by 0.2% to HK$50.03 miilion. This segement represented approximately 7.6% of the company's total revenue. Downsizing of the clinic network in Hong Kong and loss recorded in mainland China clinics were factors that caused limited growth in this segment. |

|

Plantation |

Plantation and trading of raw Chinese herbs |

Revenue dropped by 61.9% to HK$15.73 miilion. This segement represented approximately 2.4% of the company's total revenue. The loss of this segment was attributed to the non-recurring impairment loss on the biological assets as well as on the goodwill due to strucutral change of this part of the business. |

Source: Company's annual reports and interim reports

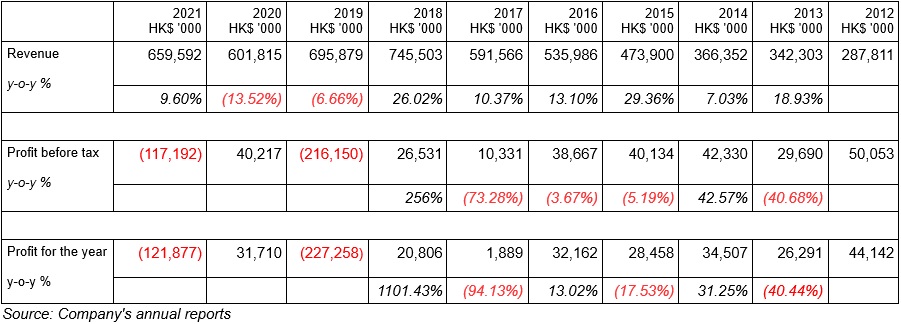

Overall financial summry of the company from 2012 to 2021:

Although the pandemic caused disruption in the overall economy, the company's revenue growth remained relatively stable. The factors that may be the key to the company's future performance: the Chinese national standards on CCMG impact and the COVID-19 pandemic.

投资涉及风险,有可能损失投资本金。你应该咨询专业人士,就本身的投资经验,财务状况,个人目标及风险取向,以提供投资意见。各类产品的风立,请参阅本公司网页http://www.phillip.com.hk「风险披露声明」。

辉立(或其雇员)可能持有本文所述有关的投资产品。此外,辉立(或任何附属公司)随时可能替向报告内容所述及的公司提供服务,招揽或业务往来。

以上资料为辉立拥有并受版权及知识产法保护。除非事先得到辉立明确书面批准,否则不应复制,散播或发布。