-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Mortgage

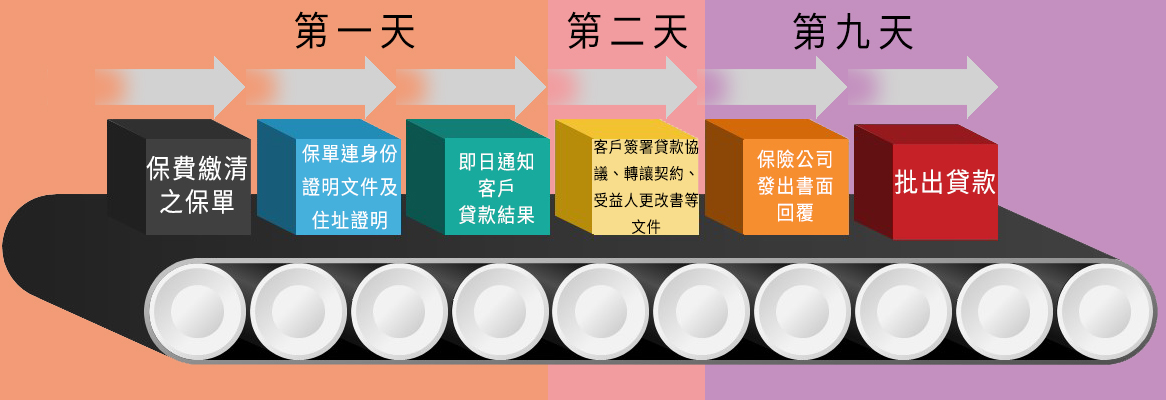

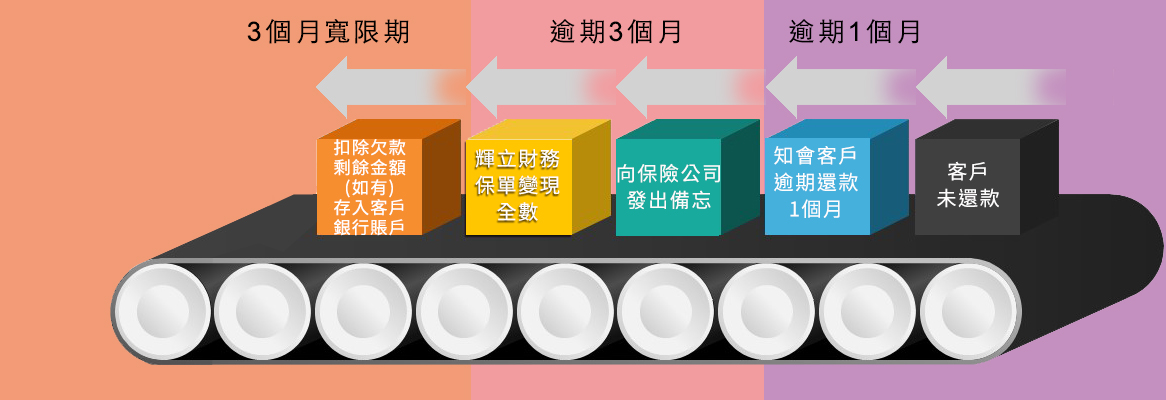

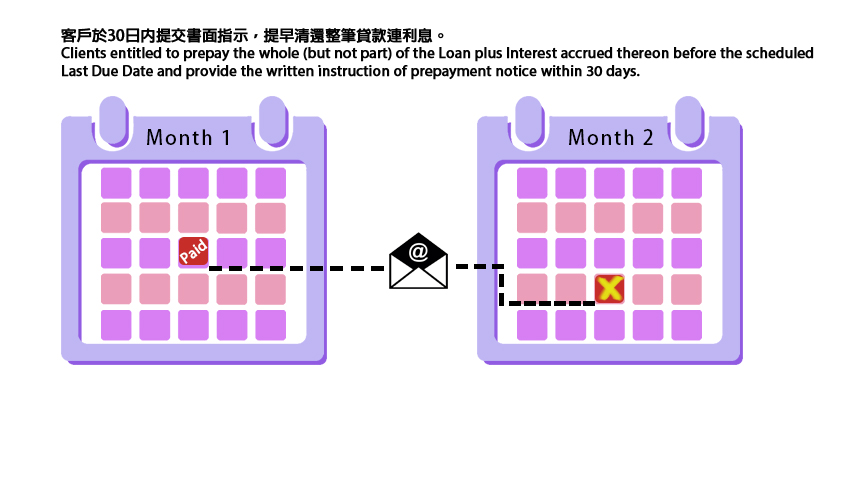

Phillip Securities Group has always committed to provide customers diversified services. Its subsidiary, Phillip Finance (HK), now offers customers a first property mortgage , second property mortgage and policy financing service. It is easy to apply, promptly approved, and personalized interest rates and loans are available. No interest would be charged before the date of drawdown of credit line.

Tier-based Interest for First Mortgage on Residential Property

The interest rate is now calculated in proportion to the loan-to-value (LTV) ratio of the mortgage loan! The lower the LTV ratio, the lower interest rate.

1.Why choose Phillip Finance?

We offer professional property mortgage services, 80% loan-to-value for property appreciation, no TU, no penalty interest for early repayment, and up to 70% loan-to-value for any property.

2. What types of properties can I apply for a property loan?

Private properties, tenement buildings, HOS, small houses, village houses, shops, factories, offices and parking spaces are all eligible for property loans, regardless of their age.

3. What is the annual interest rate of Phillip Finances' first mortgage loan?

The annual interest rate is as low as 3.88% (SCB Prime - 1.37%).

4. Are there any fees and charges during the loan processing period?

We do not charge any legal fees, handling fees or valuation fees, and the loan application process is completely free of charge. No fee will be charged if the loan application is not approved, cancelled, or if the loan is not confirmed and accepted.

5. What documents do I need to apply for a loan?

The following documents are required: identification documents (e.g. HKID card, passport), proof of address (e.g. recent rates statement, management fee statement), bank statement for the last 3 months, proof of salary for the last 3 months, loan notification letter from the financial institution.

6. How long does the approval process take after submitting the information?

If the information is complete and correct, the approval process will take about 2 to 3 working days.

7. How can I apply for a loan?

You can Apply Online Or via Phone by calling 2277 6811, WhatsApp 6266 8610, WeChat ID PFHK 2021 or via e-mail.

8.What are the other channels besides online application?

You may visit our office (Address: 11-12/F, United Centre, 95 Queensway, Hong Kong (Exit D, Admiralty Railway Station).

9. Can I apply for a loan if the property is owned by a company?

Yes, the loan can be obtained by all company owners.

10. Can I apply for a mortgage or loan if I am a Mainlander?

Yes, the applicant must provide your Chinese ID card and personal information such as proof of address, proof of employment, etc.

Kick start your journey with us today in Fintech era

Phillip Securities Group is one of the members of Phillip Capital. Phillip Capital founded in 1975 in Singapore, our group member companies operate in 15 financial hubs, with offices in Singapore, Hong Kong, China, US, Japan, UK, Australia, Malaysia, Thailand, Indonesia, Turkey, India, Cambodia and Dubai. With more than 5,000 employees and access to multi-markets across 26 exchanges worldwide, serving over 1,000,000 individual clients, families and institutional customers around the world, we are entrusted with over $35 billion US Dollars from patrons to manage their assets, and our shareholder’s fund has exceeded to $2.4 billion US Dollars.

In Hong Kong, our group companies include Phillip Securities (HK) Limited, Phillip Commodities (HK) Limited, Phillip Capital Management (HK) Limited, Phillip Financial Advisors (HK) Limited, Phillip Finance (HK) Limited, Phillip Institute of Financial Learning Co Limited and Phillip Bullion Limited. We provide a full range of quality and innovative financial services to individuals, corporate and institutional, investors including securities, futures, options, forex, unit trusts, asset management, insurance, investor education and investment research.

Milestone

The first generation of Phillip Online Electronic Mart System (POEMS) has been launched since 1998.

“PhillipMart”- our Pre-IPO matching platform since 2006, allows customers and institutions to transact IPO securities one day before listing on Exchange. Our trading volume has always ranked top among Fintech peers.

Phillip iPhone / Android has been launched since 2011.

Today, our development and offerings range from online account opening, FPS real time fund transfer, eDDA, and other infrastructure accelerating the facilitation of online trading in major global markets round-the-clock anywhere.

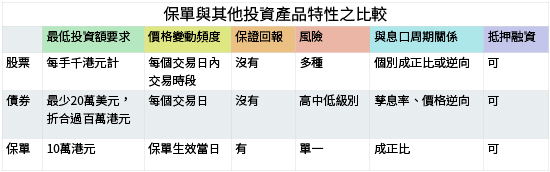

Intro of Phillip Securities Hong Kong

Stocks, Futures, Options, Forex, Bullion, Bond, Unit Trust, insurance are among the products we offer. Our service include IPO Subscription, PhillipMart, asset management, Stock Borrowing and Lending, margin financing, premium financing, MPF, property agency and mortgage.

POEMS: Award-Winning Broker

We were honored to have won awards/ have been given accomplishments as below in recent years:

| Year | Award / Accomplishment |

|---|---|

| 2014 | 2014 Top 10 HK Brokerage Firm- HEXUN.com Third Chinese(Overseas) Financial Annual Champion Award |

| 2015 | 2015 Best Internet Broker -HKCD 2015 Polling and 2016 The Greater China Financial Development and Opportunity Forum |

| 2017 | RMB Currency Options-USD/CNH Options Active Exchange Participant - HKEX |

| 2018 | HKEX Exchange Participant in Gold Futures; HKEX Key business Partner of RMB Fixed Income and Currency |

The material is in Chinese only.

![]() 個案1: 循環備用信用額

個案1: 循環備用信用額

樓宇現價: $8,000,000

剩餘按揭貸款: $0

林周先生現擁有一私人物業且沒有任何按揭貸款,而周先生剛起步的網店每幾個月便需要資金進貨。 因此他便以其物業作抵押保證,申請了400萬循環備用信用額,令到他可靈活調配資金。進貨時才提取貸款,收到貨款就可隨時償還,而利息只按每日已動用之抵押信用透支額計算,備用金助他踏上創業青雲路,解決了一直存在之周轉困難問題。

![]() 個案2: 二按

個案2: 二按

樓宇現價: $8,000,000

剩餘按揭貸款: $2,800,000

李先生現擁有一私人物業,雖然尚欠銀行280萬,但仍可向我們申請200萬二按貸款套取資金作為個人備用投資資金及子女教育基金,並即時加大流動資金以助周轉,最終靈活充裕的現金流令到他可輕鬆送子女到外地升學。

![]() 個案3: 過渡性貸款

個案3: 過渡性貸款

樓宇現價: $8,000,000

剩餘按揭貸款: $0

葉先生是一名外貿商人,由於疫情關係,外地買家突把數期延長至半年以上。與此同時,葉先生兩個月後急需付款予供貨方。面對這困局,他立刻以自己的私人物業申請一筆480萬的一年期過渡性貸款,每月只需供利息部份,直至第12個月才把本金及最後一期利息歸還。雖然至今疫情未完全消退,但最終貸款已能助他渡過難關。

![]() 個案4: 免TU

個案4: 免TU

楊先生與太太將於明年結婚並打算置業共築愛巢,可是簽訂臨時買賣合約後到銀行申請按揭貸款時卻遭到拒絕,原因是楊先生早年因過度使用信用卡致信貸紀錄欠佳。他後來經友人介紹申請一按物業貸款,由於審批程序毋須查閱過往信貸紀錄,而楊生更有穏定入息,結果輕鬆批核,總算上車成功。

![]() 個案5: 物業轉按

個案5: 物業轉按

樓宇現價: $8,000,000

一按欠銀行: $1,800,000

二按欠財務: $900,000

蘇先生的私人住宅物業於銀行按揭,現尚欠銀行180萬。另早前因為家人急需醫療費用遂向財務公司申請90萬二按周轉,及後他卻發現二按利息支出鉅大(15%年息),希望把二按結餘轉另一金融機構加按套現少量現金,由於利息降低,結果他每年還款減少。

註:按揭貸款條件及按揭貸款額須根據輝立財務有限公司最終之批核結果為準。

Promotion materials are in Chinese only, please contact (852) 2277 6677 for any enquiry.

Warning: You have to repay your loans. Don’t pay any intermediaries.

Money Lenders Ordinance Lender’s License number: 0989/2024 CR Note Complaint Hotline : 2277 6555

Top of Page

|

Customer Service Department (General Enquiries) Tel : (852) 2277 6555 Fax : (852) 2277 6008 Email : cs@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|

Mortgage Calculator

Mortgage Calculator

or e-mail

or e-mail