-

Products

- Local Securities

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Forex

Introduction to Forex

Buying and selling on the Foreign Exchange (Forex) market, takes place in currencies pairs. Two currencies will be traded for each transaction.

E.g. By trading a euro/dollar (EUR/USD) currency pair, an investor short sells US dollars to buy Euro; similarly by trading a dollar/yen (USD/JPY) currency pair, an investor short sells Japanese yen to purchase US dollars.

Enjoy competitive interest yield

Tight Forex Spreads

Low barriers to entry

Exclusive Phillip FX trading platform (XATS) & online trading platform (POEMS)

LFET price

Why trade Forex?

Risk diversification

No geographical boundaries

24-hours trading

Leveraged Forex

Flexible transaction

Trading Details

| Trading Hours |

Hong Kong time: 05:15 (Monday) to 04:59 (Saturday) (Winter-Time: postponed 1 hour) |

|---|---|

| Opening price |

The opening price (Tuesday to Friday) is determined by the price at 05:15 Hong Kong time. |

| High/low price |

The daily high and low prices (Tuesday to Friday) are determined by the high /low trading price between 05:15 to the 04:59 on following day Hong Kong time (Winter Time: postponed 1 hour). |

Trading Method

Clients may place order via our online trading platform (POEMS/XATS/POEMS Mobile App) or call our LFX dealing hotline (Hong Kong time: 05:15 (Monday) to 04:59 (Saturday), Winter-Time: postponed 1 hour), directly at (852) 2277 6667.

Trading Instruction

For every single transaction, clients may choose:

The duration of order instruction: (1) Day order or (2) Good-till-cancel order;

The type of order instruction: (1) Market order, (2) Limit order, or (3) Stop order

| Order Duration |

|

|---|---|

| Order Type |

|

Trading limit

Phillip places a trading limit on each Leverage Foreign Exchange account,capped by default Margin Limit, which determines the maximum amount of lots that a client may trade.The margin limit will be listed on the welcome letter for new client via postal mail, it will be shown on each Forex account statement under the item name “position limit”.

E.g. If the margin limit is set at HK$100,000 and the initial margin is HK$4,000. The trading limit would be 25 lots (HK$100,000/HK$4,000=25).

In the case of trading limit shortfalls during the order placing process, the orders will be rejected automatically. If you would like to raise the limit, please call our 24-hours LFX dealing hotline directly at (852)2277 6667.

Interest Charge

Margin requirement for Leveraged Foreign Exchange trading is based on Hong Kong Dollar. Please provide sufficient margin in advance before opening and holding day-trade or over-night positions.

If the equity balance is less than the required initial margin, the interest will be charged based on the shortfall margin.

If the equity balance is less than the required initial margin, the interest will be charged based on the shortfall margin.

Trading Example

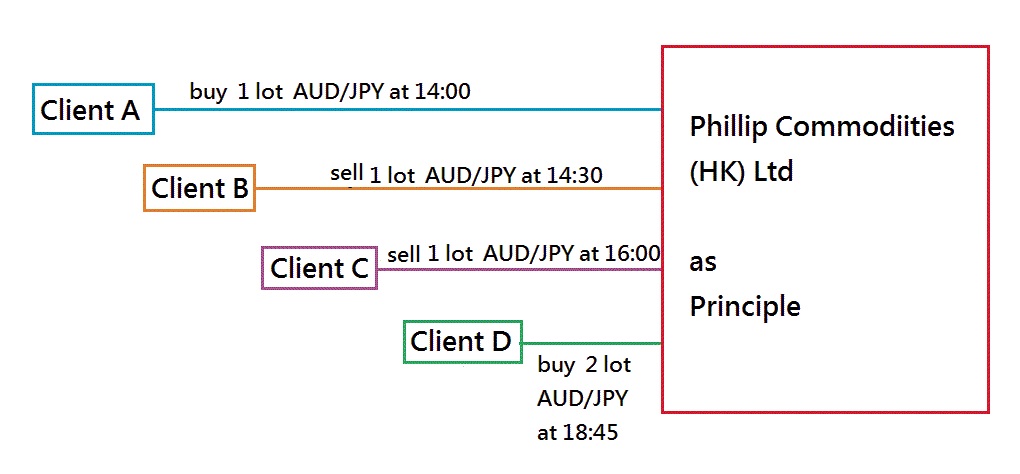

In Forex market, trading is mainly based on buying/selling a contract. Please refer to the following example:

Calculation method:

(selling price - purchase price) x contract amount x lots - commission = profit / loss

Example 1:

Client buys one lot of Euro against the US dollar (EUR/USD), and then sells at the same day| Purchase Price | Selling price | Contract Amount | Profit and Loss calculation |

|---|---|---|---|

| 1.2500 | 1.2600 | EUR10,000 | (1.2600 - 1.2500) X 10,000 - commission= USD100 - commission |

Example 2:

Client buys one lot US dollar against Japanese Yen (USD/JPY),and then sells at the same day| Purchase Price | Selling price | Contract Amount | Profit and Loss calculation |

|---|---|---|---|

| 107.00 | 105.00 | USD10,000 | (105.00 - 107.00) X 10,000 - commission = JPY-20,000 - commission |

In the above examples, commission needs to be deducted from the final figure to determine the net profit/loss for the transaction. Please note that the examples above depict a day order trade only. For overnight positions, clients are reminded to include the receivable/payable interest in order to calculate the net profit/loss.

Commission Fees

Minimum commission of online trade is HKD 6 per lot per side。Minimum commission of phone dealing is HKD10 per lot per side(effective from 3rd April 2017)。The commission of HKD / CNH and CNH / JPY contract are waived.

Currency List

Multi Currency Options

Major Trading Currencies

| Category | Contract units per lot | Spread* | Value per point | |

|---|---|---|---|---|

| Euro Dollar against US Dollar | EUR/USD | EUR 10,000 | 0.5 pips | USD 1 |

| US Dollar against Japanese Yen | USD/JPY | USD 10,000 | 0.5 pips | JPY 100 |

| British Pound against US Dollar | GBP/USD | GBP 10,000 | 1 pips | USD 1 |

| US Dollar against Swiss Franc | USD/CHF | USD 10,000 | 2 pips | CHF 1 |

| Australian Dollar against US Dollar | AUD/USD | AUD 10,000 | 1 pips | USD 1 |

| US Dollar against Canadian Dollar | USD/CAD | USD 10,000 | 2 pips | CAD 1 |

| New Zealand Dollar against US Dollar | NZD/USD | NZD 10,000 | 2 pips | USD 1 |

| US Dollar against Offshore Traded Renminbi | USD/CNH | USD 10,000 | 5 pips | CNH 1 |

| Hong Kong Dollar against Offshore Traded Renminbi | HKD/CNH | HKD 10,000 | 2 pips | CNH 1 |

Cross rate

| Category | Contract units per lot | Spread* | Value per point | |

|---|---|---|---|---|

| Euro Dollar against Japanese Yen | EUR/JPY | EUR 10,000 | 1 pips | JPY 100 |

| Euro Dollar against British Pound | EUR/GBP | EUR 10,000 | 1 pips | GBP 1 |

| Euro Dollar against Swiss Franc | EUR/CHF | EUR 10,000 | 4 pips | CHF 1 |

| Euro Dollar against Australian Dollar | EUR/AUD | EUR 10,000 | 2 pips | AUD 1 |

| British Pound against Japanese Yen | GBP/JPY | GBP 10,000 | 2 pips | JPY 100 |

| Australian Dollar against Japanese Yen | AUD/JPY | AUD 10,000 | 2 pips | JPY 100 |

| New Zealand Dollar against Japanese Yen | NZD/JPY | NZD 10,000 | 2 pips | JPY 100 |

| Swiss France against Japanese Yen | CHF/JPY | CHF 10,000 | 3 pips | JPY 100 |

| Australian Dollar against New Zealand Dollar | AUD/NZD | AUD 10,000 | 2 pips | NZD 1 |

| Canadian Dollar against Japanese Yen | CAD/JPY | CAD 10,000 | 2 pips | JPY 100 |

| Offshore Traded Renminbi against Japanese Yen | CNH/JPY | CNH 10,000 | 1 pips | JPY 100 |

| Australian Dollar against Offshore Traded Renminbi | AUD/CNH | AUD 10,000 | 15 pips | CNH 1 |

| Euro Dollar against Offshore Traded Renminbi | EUR/CNH | EUR 10,000 | 13 pips | CNH 1 |

* The bid-ask spread may change depending on market condition without notification.

Currency Interest

If an investor holds a position overnight ,they may pay/receive related currency interest. Besides, investors should always consider the currency volatility prior before considering the expected receivable interest. Phillip uses “swap point” calculation as a means to record a client's payable/receivable interest.

Interest Calculation

Example 1: The client is entitled to receivable interest; Phillip will reduce the client's purchase price to reflect client’s receivable interest.

Client buys one lot of New Zealand dollar (NZD / USD). Open position for ten days.

| Price | Swap point(long positions) | Accumulated swap points | Client's purchasing price |

|---|---|---|---|

| 0.8015 | -0.000037(reference rate 1.68%) | -0.000037*10 =-0.00037 | 0.8015 + (-0.00037) = 0.80113 |

Example 2: The client is entitled to receivable interest; Phillip will increase selling price to reflect client’s receivable interest.

Client sells one lot of US dollar (USD / CNH). Open position for ten days.

| Price | Swap point(short positions) | Accumulated swap points | Client's selling price |

|---|---|---|---|

| 6.54502 | 0.000109 (reference rate 0.60%) | 0.000109 x 10 = 0.00109 | 6.54502 + (0.00109) = 6.54611 |

Example 3: In the case of payable interest, Phillip will lower the selling price to reflect the interest payable.

Client sells one lot of Euro (EUR/USD). Open position for ten days

| Price | Swap point(short positions) | Accumulated swap points | Client's purchasing price |

|---|---|---|---|

| 1.3015 | -0.000007(reference rate -0.20%) | -0.000007*10=-0.00007 | 1.3015 + (-0.00007) = 1.30143 |

Example 4: In the case of payable interest, Phillip will increase client's purchasing price to reflect the interest payable.

Client buys one lot of Euro (EUR/USD). Open position for ten days

| Price | Swap point(long positions) | Accumulated swap points | Client's purchasing price |

|---|---|---|---|

| 1.3018 | 0.000008(reference rate -0.23%) | 0.000008*10=0.00008 | 1.3018 + (0.00008) = 1.30188 |

While buying high yielding currencies in order to earn the interest is a viable investment strategy. Investors should note that investing in the wrong direction could cause substantial losses and the interest received is often insufficient to compensate the loss; so investor should first consider the movements of the currency and then the interest earned/paid.

Margin Policy

Margin Table

| Margin Requirement | Percentage |

|---|---|

| Initial Margin | 5.00% |

| Maintenance Margin | 3.00% |

| Force Liquidation Level | 1.00% |

Margin Calculation

If client buys 1 lot EUR/USD at 1.3, the contract size is EUR10,000 and the Rate of USD/HKD is 7.778 (for reference).

| Category | EUR Price | Contract size | Rate of USD/HKD | Margin Requirement |

|---|---|---|---|---|

| Initial Margin | 1.3 | EUR10,000 | 7.778 | HKD5,055.70 |

| Maintenance Margin | 1.31 (EUR increases) | EUR10,000 | 7.778 | HKD3,056.80 |

Initial margin

The client is required to provide sufficient initial margin prior for Forex trading, and the equity balance must be at least kept at the maintenance margin level of all open positions.

In the case of margin shortage during order placing process, Phillip may either:- For order placed via platforms, reject the order automatically.

- For market order via direct hotline, partial trade order may be executed according to the most updated margin status.

- For working order, order will be rejected even the preset price level is reached.

Margin Call

When the account equity falls below the maintenance margin level, Phillip will make best effort to issue margin call via phone, email or text message (where applicable) etc., requesting the client to restore the account equity to the initial margin level within a specified time via one of the following actions:

- Deposit the margin amount; or

- Transfer from other Phillip accounts; or

- Close out the open positions.

Otherwise, Phillip will force liquidate the open positions. Client shall remain liable for any deficit in the account.

Moreover, at volatile market conditions, Phillip reserves the right to call for margin deposit from time to time. Client should always pay attention to open positions and allow sufficient equity to cover potential margin shortfall.

Force Liquidation

- Phillip will make best effort to call client margin, however, it may not be able to contact client in a timely manner due to various reasons (including volatile market conditions). If client cannot restore the account equity to initial margin level within specified time or if the account equity falls below the "Force Liquidation level", Phillip may request client to or force close position(s).

- If equity falls below the required margin level or has negative balance when market opens after weekend or holiday, Phillip will make best effort to call client margin or force close position(s) at market price. Client shall remain liable for any deficit in the account.

- Phillip will notify client of any force liquidated position(s) by telephone, email or message, and also identified those transactions in the statement. If the force liquidation is not sufficient to cover negative balance in the account, client shall remain liable for any deficit in the account.

- The risks associated with leveraged foreign exchange trading can be extremely high. During volatile market conditions, Phillip may not be able to immediately close positions on accounts that have fallen beyond the force liquidation level. The client may suffer a loss in excess of the initial margin amount.

You can open a Phillip Account via several ways:

(1) Visit our offices in person (Head office and branches information)

(2) Open account through online

Points to note:

A. Face-to-face Customers

Please visit our office in person with the following documents:

1. Account Opening Form

A. Phillip Securities (Hong Kong) Limited

B. Phillip Commodities (HK) Limited

D. Phillip Capital Management (HK) Ltd.

2. W-8BEN Form

3. Copy of valid identification document (e.g. HK Permanent ID Card/ Passport)

4. Proof of residential address within 3 months after issue (e.g. utility bills, bank statements)

5. Bank account supporting documents (e.g. ATM card, Passbook, Statement or Bank Account Reference Letter)

Reminder: Please read the relevant Client Agreement and Risk Disclosure before opening Trading Account.

B. Non face-to-face Customers

You can open an account by post. Please mail the above-listed required documents to the below address: Phillip Securities (HK) Limited, 11-12/F United Centre, 95 Queensway, Admiralty, Hong Kong:

Additionally, customers must choose one of the procedures below to verify his/ her true identity:

(A) Mail a crossed personal cheque of HK$10,000. This deposit can be used for trading.

The cheque must satisfy the following requirements:

1 Cheque made payable to the relevant Company names;

2 Must be a personal cheque drawn on a licensed bank in Hong Kong; and

3 Must bear identical name and signature as shown on Account Opening form.

(B) Certify all mailed documents by notary public or professionals (e.g. lawyer, certified public accountant, branch manager of a bank or any other licensed registered person).(C) Customers can visit our designated law firms in China for witness services. Please contact our Customer Service Department for further details.

C. Company Account

Please submit the following corporate documents:

1. Certificate of Incorporation*

2. Business Registration Certificate*

3. Proof of address (within 3 months)*

4. List and identification of Directors and Authorized Signatories*

5. List and identification of shareholders and ultimate beneficiaries*

6. Company Search (within 6 months)/ Certificate of Incumbency (within 6 months)*

7. Memorandum and Article of Association*

8. Board Resolutions

9. Letter of Guarantee with guarantor’s address proof (identification of guarantor if other than director or shareholder)

10. Latest Audited Accounts/ Certificate of Good Standing

11. W-8BEN-E Form

Item 1 to 7 should be certified by designated persons (e.g. Phillip employees, lawyer, certified public accountant, branch manager of a bank, or any other licensed person).

Attention:

Unless receive special approval, we do not accept account opening applications from the following companies:

1. Licensed corporations without FATCA registration; or

2. Entities registered in the U.S.ANote: Any transaction, movement and position traded through our companies will be reflected in client’s daily and monthly statement. Please review carefully.

The risk of loss in trading leveraged foreign exchange can be substantial. Please refer to this link for the Risk Disclosures Statement

Top of Page

|

Please contact your account executive or call us now. Forex Tel : (852) 2277 6667(Mon. 7:00 am ~ Sat. 5:00 am) Email : forex@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|