-

Products

- Local Securities

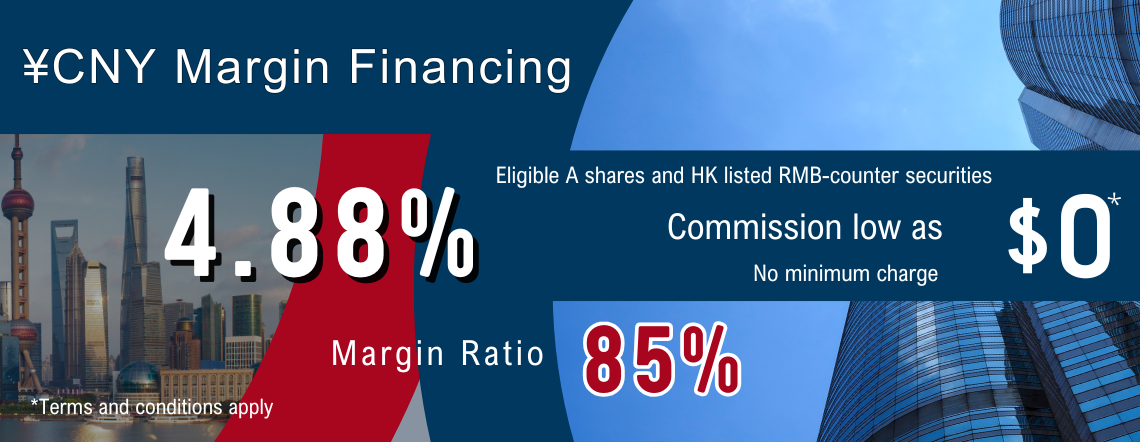

- China Connect

- Grade Based Margin

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

China Connect

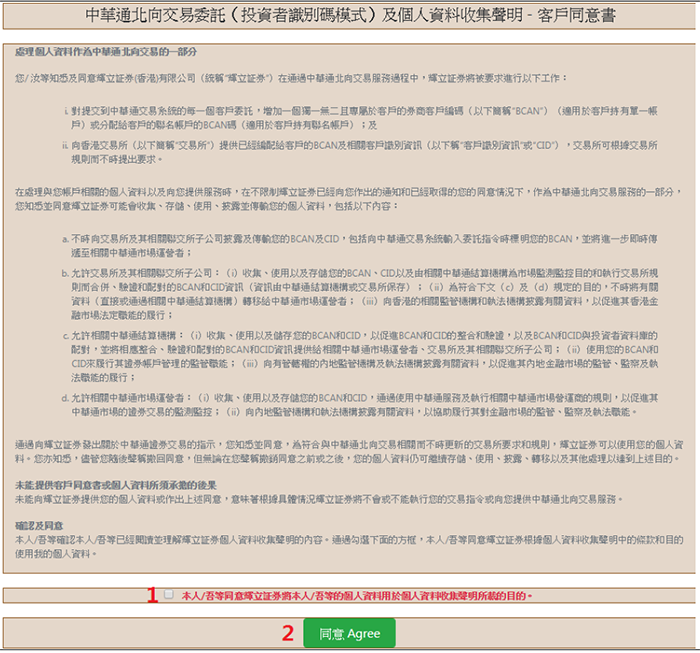

Account Opening

Hong Kong and Oversea investors could open an account with us for Shanghai/Shenzhen-Hong Kong Stock Connect trading, please click here for more details.

Trading Arrangement

Same as the current arrangement for trading Hong Kong stocks, investors who want to participate in Shanghai and Shenzhen Connect will trade through SEHK Participants(e.g.Securities brokers). Investors should check with their SEHK Participants on any specific conditions that their SEHK Participants may require them to satisfy before accepting their Northbound orders. Northbound trades are executed on the SSE/SZSE platform, and therefore follow the SSE/SZSE market practices in general. This Section explains the market practices that are applicable to Northbound and Southbound under Shanghai and Shenzhen Connect.

It is contemplated that SEHK, SSE and SZSE would reserve the right to suspend Shanghai Connect and/or Shenzhen Connect respectively if necessary for ensuring an orderly and fair market and that risks are managed prudently. Suspension may be executed for a specific stock or all stocks of the relevant market(s). Consent from the relevant regulator would be sought before a suspension is triggered.

Trading Comparision between Shanghai and Shenzhen Stock Connect A shares and Hong Kong Stock

| Shanghai Stock Connect、 Shenzhen Stock Connect A Shares | Hong Kong Stocks | |

| Investment Quota | Subject to a Daily Quota RMB 13 billion for each market |

N/A |

| Settlement Currency | Renminbi Phillip could provide preferential exchange rate of Renminbi for money settlement) |

Hong Kong Dollar or Renminbi |

| Stock Code | 6 digits | 5 digits at most |

| Board Lot | 100 shares per lot | Customized by the listed company |

| Settlement Date | Stock: On T day; Money: On T+1 day |

Stock and Money: T+2 day |

| Order Types | Only accept limit orderscan be matched at the specified price or a better price) | at-auction(market price), limit and others, 5 types of order in total |

| Order amendment | Not allowed (The order must be cancelled and input again.) |

Allowed. |

| Tick Size | Uniformly at RMB 0.01 | Tick Size differ in the securities |

| Price Limit |

|

No |

| Dynamic price checking |

|

No |

| Maximum order size per transaction | 1 million shares | 3,000 lots |

| Odd Lot |

Only available for sell orders and all odd lots should be sold in one single order. |

Odd lot could be only matched and sold on the specific platform through account executives. Odd lot trading may likely be executed at a price which is not as favourable as the prevailing market price. |

| Turnaround Trading ("Day trade") |

Not allowed | Allowed |

| Block Trades | Not allowed | Allowed |

| Manual Trades | Not available | Available |

Quota

Trading under Shanghai and Shenzhen Connect will be subject to a Daily Quota.

Daily Quota is set at RMB 13 billion for each of Shanghai Connect and Shenzhen Connect,Daily Quota Balance will be updated on the HKEX website every minute。

Daily Quota Balance = Daily Quota – Buy Orders + Sell Trades + Adjustments

- The Daily Quota is applied on a “net buy” basis.

- Investors are always allowed to sell their cross-boundary securities regardless of the quota balance.

- The Daily Quota will be reset every day. Unused Daily Quota will NOT be carried over to next day’s Daily Quota.

- If the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during the opening call auction session, new buy orders will be rejected.

- Once the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during a continuous auction session, no further buy orders will be accepted for the remainder of the day.

- Buy orders already accepted will not be affected by the Daily Quota being used up and will remain on the order book of SSE and SZSE respectively unless otherwise cancelled by relevant SEHK Participants.

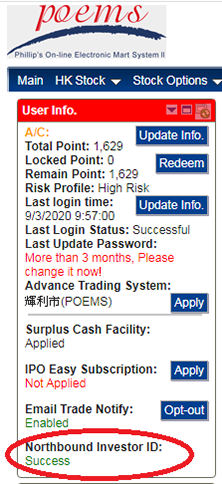

Pre-trade checking

In general, Mainland investors are only allowed to sell SSE-listed and SZSE-listed securities which are available in their stock accounts at the end of the previous day. Based on the shareholdings of an investor, SSE/SZSE will reject a sell order if the investor does not have sufficient shares in his account.

SEHK applies similar checking on all Northbound sell orders to ensure there is no overselling by individual SEHK Participants. Under SEHK’s pre-trade checking model, sell orders will be rejected if the cumulative sell quantity for the day is higher than the SEHK Participant’s shareholding position at market open. Therefore, when placing sell orders, investors must ensure they have sufficient shares in their accounts opened with the SEHK Participant who acts as the selling broker. If the shares are kept in an account opened with another SEHK Participant or a custodian, investors must first transfer the shares to the selling SEHK Participant on T-1 in order to sell their shares on T day. A Special Segregated Account (“SPSA”) arrangement as mentioned below has been put in place, in which case investors whose Connect Securities are maintained with custodians may sell their Connect Securities without having to pre-deliver the Connect Securities from their custodians to their executing brokers. Please read the information book for investor to get more details.

Shanghai and Shenzhen Stock Connect Trading Hours

Northbound trading follows SSE’s and SZSE’s trading hours. However, SEHK will accept Northbound orders from SEHK Participants five minutes before the Mainland market sessions open in the morning and in the afternoon.

| Trading hours | Shanghai Stock Connect | Shenzhen Stock Connect | ||

| SSE Trading Hours | Time for SEHK Participants to input Northbound orders | SZSE Trading Hours | Time for SEHK Participants to input Northbound orders | |

|---|---|---|---|---|

| Opening Call Auction | 09:15-09:25 | 09:10-11:30 | 09:15-09:25 | 09:10-11:30 |

| Continuous Auction (Morning) | 09:30-11:30 | 09:30-11:30 | ||

| Continuous Auction (Afternoon) | 13:00-14:57 (to be commenced on 20 Aug 2018) | 12:55-15:00 | 13:00-14:57 | 12:55-15:00 |

| Pre-close / Closing Call Auction Session | 14:57-15:00 (to be commenced on 20 Aug 2018) | 14:57-15:00 | ||

| Note |

|

|

||

Holiday、Half trading day、Severe Weather Conditions

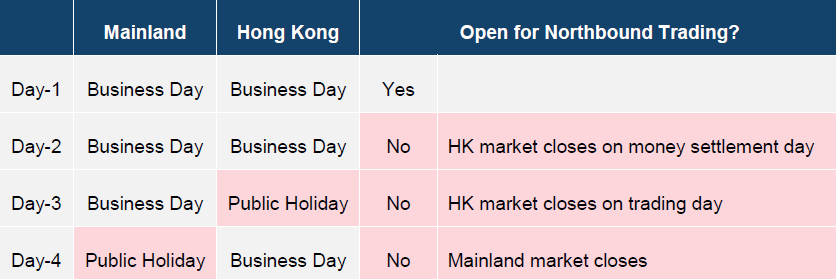

Holiday

Investors will only be allowed to trade on the other market on days where Hong Kong and Mainland markets are both open for trading, and banking services are available in both Hong Kong and Mainland markets on the corresponding settlement days. This arrangement is essential in ensuring that investors and brokers will have the necessary banking support on the relevant settlement days when they will be required to make payments.The following table illustrates the holiday arrangement of Northbound trading of SSE/SZSE Securities:

Half day trading

If a Northbound trading day is a half trading day in the Hong Kong market, Northbound trading will continue until respective Connect Market is closed. Please refer to the HKEX website for the Northbound trading calendar for Shanghai Connect Northbound trading and Shenzhen Connect Northbound trading.Severe Weather Conditions

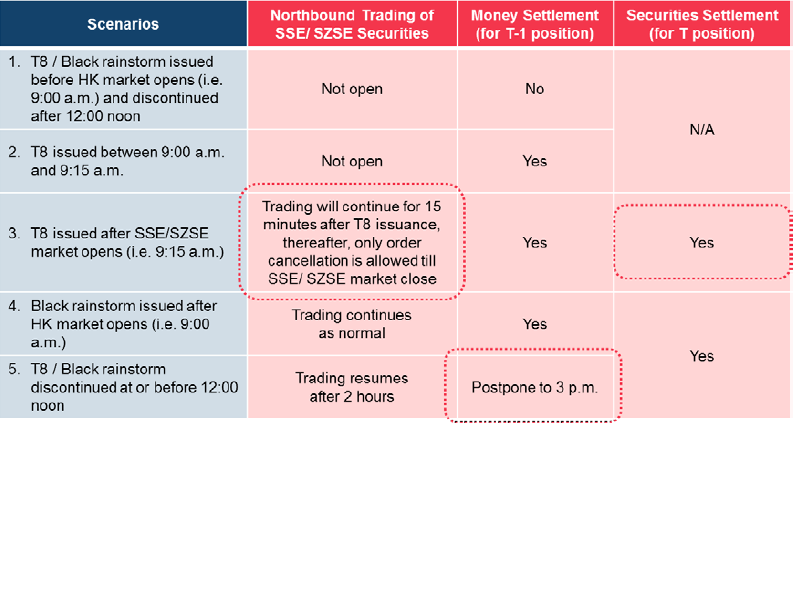

The trading arrangement under severe weather conditions is as follows:

For details of the existing typhoon/rainstorm procedure for the Hong Kong market, please refer to the HKEXwebsite.

Eligible Stocks for China Connect

Certain stocks listed on the SSE market (“SSE Securities”) can be traded , including all the constituent stocks from time to time of:

- constituent stocks of the SSE A Share Index and the SZSE Composite Index which have a market capitalisation of RMB5 billion or above and meet certain requirements such as liquidity criteria

- SSE/SZSE-listed stocks of companies which have issued both A-shares and H-shares.

- Initial List of ETFs Eligible for Northbound Trading

- SSE-listed/SZSE-listed shares which are not traded in RMB; and

- SSE-listed/SZSE-listed shares which are included in the alert board. If it is subsequently removed from the risk alert board, it will be accepted as a SSE / SZSE Security if it remains as a constituent stock of the relevant indices or if its corresponding H share continues to be listed and traded on the SEHK (as appropriate).

- Only institutional professional investors are eligible to trade shares that are listed on the ChiNext Board of SZSE under Northbound trading at the initial stage of Shenzhen Connect,

- Initial Public Offering

The full list of SSE Securities will be published on the HKEx website, which will be updated from time to time with advanced notice to the market. Reference link:

The information above are provided by HKEX. The latest version released by HKEX shall prevail in case of any changes.

Important Notes and Specific Risks of trading via Shanghai-Hong Kong Stock Connect and/or Shenzhen-Hong Hong Stock Connect (China Connect), please click here,or visit HKEX website to view Information Book for Investor and Frequently Asked Questions

Top of Page

|

Customer Service Department (General Enquiries) Tel : (852) 2277 6555 Fax : (852) 2277 6008 Email : cs@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion 新闻稿 |

E-Check Login |

Investor Notes Free Subscribe |

|